At Risevest, one of our operating principles is to seek investment prospects that can withstand market volatility, ensuring optimal returns for our clients.

Following this, we added HIMS, a telehealth company, rapidly growing into one of the biggest players in the American healthcare space, to our stock portfolio.

Summary

Hims & Hers Health Inc. operates a direct to consumer healthcare model that has combined telemedicine conversations, a massive healthcare professionals network, a compelling mobile app experience and online drug prescriptions and delivery into a massive cash creation machine growing rapidly into one of the biggest players in the American healthcare space.

Why They’re Valuable

Hims & Hers ($HIMS) has been growing rapidly by offering a digitally delivered healthcare experience that is targeted at a young but growing slice of the American population. They narrowed their offerings to a few key niches: weight loss, sexual health, mental health, women’s health and skin/hair care that are most in demand by their target audience.

HIMS is pulling off a very complicated task: making healthcare delivery both more personalized and simultaneously more affordable. Their treatments often cost less than an equivalent treatment with in person care, leading to more stickiness and high retention of their users.

The company is more than just a beautiful app; they have their own network of medical providers and also operate pharmaceutical facilities that allow them to offer care and medication below average industry cost. They are a deflationary offering in the midst of an inflationary sector plagued by high costs, making them incredibly attractive.

Their Numbers

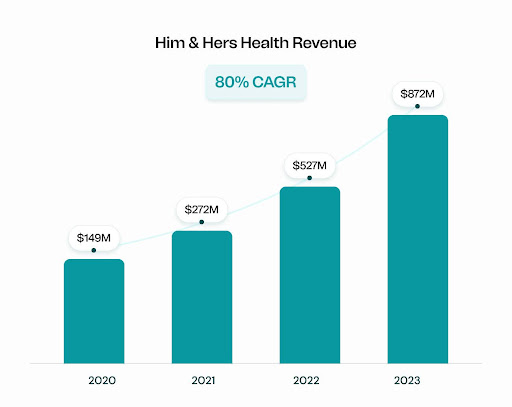

HIMS had a revenue of $872M in 2023, a 65% increase from their $528M revenue in 2022, which in turn was a 93% jump from their $272M revenue in 2021. Remarkably, as their revenue has grown rapidly, their gross margin has also increased from 73% in 2020 to 82.4% in the last 12 months.

This combination of fast revenue growth and margin expansion is uncommon and a strong sign of both growing demand and scale efficiency. HIMS’ net income is still negative although it has dropped from a loss of -$107M in 2021 to only -$5.2M in the last 12 months. They have a pristine balance sheet with virtually no debt and a $192M cash position on its books.

The company’s cash flow generation paints an even more impressive picture as they generated a positive cash flow from operations of $73.5M in 2023 and are still reporting strong growth in cash flow in Q1 of 2024. And they have 10M subscribers and counting on their app.

Our Thesis

We believe that HIMS is building a durable competitive moat around the combination of offerings it has and the fact that it is vertically integrated from customer, medical providers, pharmaceutical manufacturing along with a strongly retentive app.

They are increasingly making money from subscriptions which create revenue stability and they are growing rapidly via both word of mouth and paid acquisition. The addition of weight loss medication programs to their offerings and more personalizations across all their programs has seen their demand soar, which makes them even more compelling as an investment.

A profitable healthcare company is also relatively resilient if not completely recession proof given that people on these healthcare subscriptions are unlikely to abandon them except for extreme cases. This makes their 10M subscribers very valuable in a defensive market environment like we’re currently in.

We believe that given their lower cost and higher quality approach, they will continue to grow revenue at a strong pace and that today’s valuation of $4.4B (5x 2023 revenue) is an attractive buying opportunity for what might end up being a generational company in the healthcare space. We’ve opened a buy position and added this stock to our portfolio.

Risks

HIMS still has net profitability issues as they invest heavily into the infrastructure, especially manufacturing and marketing costs that drive their current product performance. If they lose pricing power either due to inability to manage costs or a change in the competitive landscape, they may not perform according to expectation. We rate this risk currently as low.

A second risk is that the founders through a dual class common stock structure hold over 90% of the outstanding voting power which means that the board has no power to veto his decision or remove him from office. This has proven helpful to companies like Meta in driving risky bets and stable execution but it could also be a risk if the CEO loses his way strategically or operationally.