An economic recession is when a nation’s Gross Domestic Product (GDP) falls for two consecutive quarters. It is a significant and widespread decline in economic activities. Investments generally perform poorly during recessions.

Some signs of recession include falling consumer confidence, rising unemployment, high inflation causing a fall in purchasing power, and declining sales and production for businesses. All these symptoms cause investors’ confidence and stock prices to fall.

Recessions are relatively rare and often do not last long. While most investments recover a few years after a recession, there are also ways to protect your investment against the poor performance investments suffer during recessions.

Learn all about recessions and how they affect you in this article.

How to Hedge

The most effective way to hedge investments against loss is through derivative contracts. However, derivatives are very sophisticated tools that mainly professional investors use in their portfolios.

Here are some hedging methods that involve derivatives and others that don’t.

De-risk your portfolio

The first way to hedge your investment portfolio against a recession is to move from risky to safe-haven assets. While every investment has an element of risk involved, some investments have higher risk than others.

Low-risk assets are government bonds, treasury bills, and corporate bonds of companies with high credit ratings in developed countries. All other assets have higher risk.

As fears of recession increase, investors looking to protect (hedge) against a fall in the value of their investment sell their risky assets to buy low-risk assets. This causes the prices of risky assets to fall. The stock and crypto markets are currently experiencing a sell-off. We are currently seeing a sell-off in stock and crypto markets.

Explore Other Asset Classes

Asset classes with returns that are less reliant on economic growth tend to perform better than others. These include precious metals like gold and silver and commodities like heavy metals.

Investors looking to hedge their portfolios against recessions tend to move their funds into precious metals and commodities.

Short Risky Assets

A more sophisticated strategy that professionals employ is to benefit from the fall in the prices of risky assets. They do this by short-selling risky assets like specific stocks of companies or Exchange Traded Funds (ETFs) of markets that are likely to be hard hit by the recession.

Some definitions

Short selling

The simple principle behind buying and selling is to buy at a lower price and sell at a higher price. If you sell when prices fall lower than the price you bought, you will do it at a loss. This is where short selling comes in.

Short selling is simply selling at the current price you enter into a trade and buying at a lower price in the future. It is promising to sell something in the future for a high price that was fixed today.

For example, if you go short on a stock with a strike price of 100 today and tomorrow, the price falls to 80, you can buy the stock for 80 in the market today and sell at the 100 you entered the short position in.

Long buying

Long buying or taking a long position is the opposite of short selling. It is the typical way investors buy and sell stocks on the stock market. To profit from a long position, you buy a stock and sell it at a higher price.

Exchange-Traded Funds

An exchange-traded fund is a fund that is traded on an exchange. A fund is a collection or pool of money from different people/sources to invest in a stated purpose. A fund, like the Vanguard S&P 500, collects money from different investors to invest in all the top 500 companies in the US.

Short Risk, Long Risk Free

Another sophisticated strategy would be making a pair trade where investors short risky assets and buy (go long on) stocks or ETFs that are likely to do better in a recession. They profit when the price of the risky asset falls and when the lower risk asset rises in price.

How to Invest During Recessions

Buy and Hold

Some of the best deals present themselves during market slumps. That’s when value investors like Warren Buffett go hunting for good deals because many high-quality assets are selling cheaply.

So if you have some cash set aside, buying during the recession and holding for the long haul can be a good strategy.

Dollar-Cost Averaging

Dollar-Cost averaging is simply breaking a bulk purchase into smaller units and buying periodically. Here’s a simple illustration to explain how it works.

Let’s consider the story of Jack and Jill.

Jack and Jill decided to start investing in the stock market in January 2020. They didn’t do much research because they honestly didn’t know what to look at, but they knew Apple was a great company. Many people buy Apple products, so that means they should be making money.

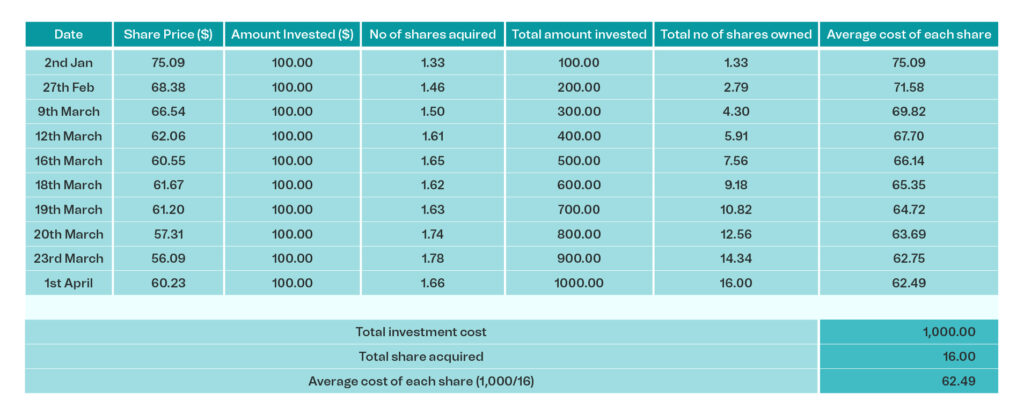

They both had a total of $1,000 each to invest. On January 2nd 2020, they bought Apple shares at $75.09 (post stock split figure). The pandemic happened, and all of 2020 went on as we know it.

Nine months later, on the 1st of September, 1 unit of Apple share was trading at $134.18. Jack’s $1,000 investment on was worth $1,786.92, a 78.69% increase. On the other hand, Jill’s $1,000 investment was worth $2,147.34, a 114.73% increase.

Why the difference?

Jack invested all his $1,000 at once on January 2nd at the average cost per share of $75.09, which gave him 13.32 shares of Apple. On the 1st of September, 1 Apple share was worth $134.18, which meant that each share had made $59.09 or 78.69%, and his total profit was $786.92.

Jill instead, decided to break her investment into small units. She started with a $100 investment and initially decided to continue investing $100 every month. But she noticed that the value of her investment kept going up steadily till on the 27th of February, when her investment went down by 8.94% to $68.38.

She saw this as a great opportunity (a Black Friday kind of opportunity) to get more shares than she did in January for the same $100. On the 9th of March, she saw the price of Apple shares fall again to $66.54., “Another Black Friday”, she thought, so she bought more. As the price of the share kept falling, she kept buying more. Here’s what that looked like:

By September 1st, she had 16 shares (compared to Jack’s 13.32 shares) at an average price of $62.49 (compared to Jack’s at $75.09), which led to a profit otf $71.69 on each share or 114.73% growth and total profit of $1,147.34.2131

What Jill did is called Dollar-cost averaging (DCA). As you see asset prices fall, if you have some cash and still believe in the asset you are invested in, you can buy some more to reduce your average cost per unit. This can improve the return you eventually get if the asset eventually recovers.

Don’t panic sell

Don’t panic when asset prices fall. If you sell at a price lower than what you bought, you will incur a loss on your investment. Some investors say they will sell at a loss, buy at a lower price, and recover their losses as prices rise. While this is a decent strategy, in theory, it’s often tough to implement.

It takes a tremendous amount of resilience to sell at a loss and decide to continue investing after. It’s like having your fingers burnt or cut off. It’s difficult to go back in afterwards. Also, it is hard to buy at the bottom. It is more likely that you will buy at a point where the stock will get worse before it gets better.

In theory, it’d be more profitable to sell at a loss, buy at a lower price and make a larger profit when the stock recovers. But it’s challenging to execute this profitably. You’ll be better off staying invested and dollar-cost averaging if you have some extra cash set aside.

Cut your Losses

If something has fundamentally changed in the company you are invested in that makes future growth prospects seem bleak, it is reasonable to sell at a loss. Some stocks will never recover after they fall during a recession.

If you feel uncomfortable with the risk or believe that the assets you are currently invested in are unlikely to recover to previous highs, you should probably sell at a loss now. Because remember, the asset price can go even lower, which will lead you to lose even more money if you don’t sell.

Conclusion

Recessions can be very hard on investing. But with the right investment and hedging strategy, you can protect yourself and sometimes even make profits during recessions. If you need some help investing your funds, check out Rise’s portfolio offerings today.